Best Banks for Home Loans in Navi Mumbai: Interest Rates & Processing Fees (2026 Guide)

Buying a home in Navi Mumbai is a milestone. Whether it’s a sea-facing apartment in Palm Beach Road or an affordable investment in Ulwe, the excitement of “owning a home” is unmatched. But let’s be real—before you get the keys, you need the cash.

Choosing the right home loan partner is arguably more important than choosing the property itself. Why? Because a difference of just 0.5% in interest rates can save you lakhs of rupees over a 20-year tenure.

In this 2026 guide, we cut through the marketing jargon to rank the Best Banks for Home Loans in Navi Mumbai. We compare interest rates, processing fees, and—most importantly—how easy they make the paperwork for CIDCO and NMMC properties.

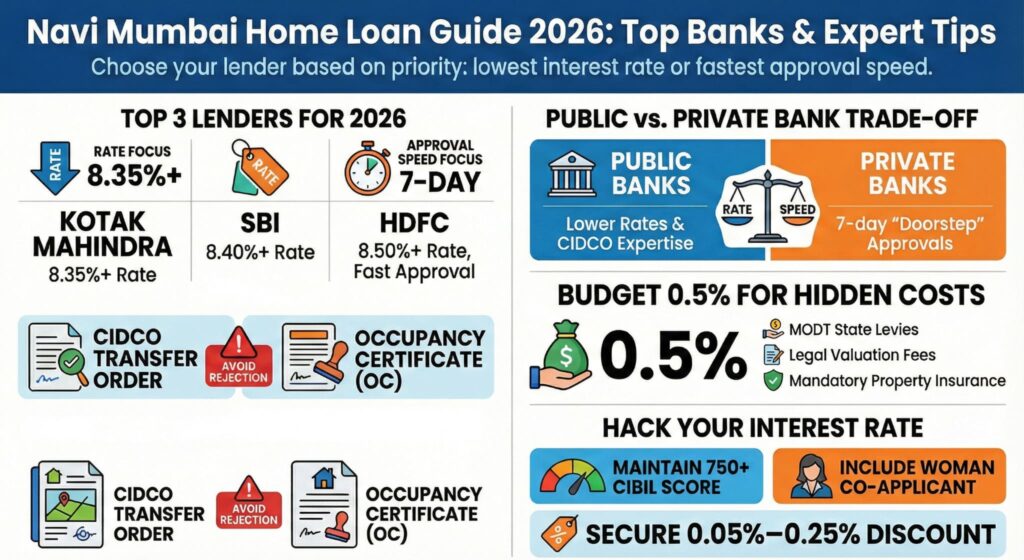

Quick Verdict: Top 3 Banks at a Glance

| Bank/HFC | Interest Rate (p.a.)* | Processing Fee | Best For |

| SBI (State Bank of India) | 8.40% – 9.15% | Low / Nil (Festive Offers) | Lowest Interest Rates |

| HDFC Bank | 8.50% – 9.40% | ₹3,000 – ₹5,000 + GST | Fast Approvals & Service |

| Kotak Mahindra Bank | 8.35% – 8.95% | 0.25% – 0.50% | High CIBIL Score Holders |

Note: Rates are indicative for 2026 and depend on CIBIL score and loan amount.

1. State Bank of India (SBI)

The “Gold Standard” for Interest Rates

In Navi Mumbai, SBI is the undisputed king of home loans for one reason: Trust. Since they are a public sector bank, their interest rates are often the lowest in the market, linked directly to the Repo Rate.

- Why Choose SBI?

- Daily Reducing Balance: Interest is calculated on the principal outstanding at the end of each day, which saves you money compared to monthly reductions.

- CIDCO Expertise: SBI’s legal team in the CBD Belapur branch is incredibly experienced with CIDCO transfer papers, meaning fewer legal hurdles for resale properties.

- Overdraft Facility: Their “MaxGain” product allows you to park surplus cash in your loan account to save on interest.

- The Downside: The paperwork. Be prepared for multiple visits to the branch and a stricter verification process.

- Processing Fee: Often waived during festive seasons (Diwali/Gudi Padwa). Otherwise, approx 0.35% of the loan amount.

2. HDFC Bank

The “Speed King” of Approvals

If you need a loan fast (e.g., to close a deal on a hot property in Vashi), HDFC is your best bet. Now merged with HDFC Ltd, they have a massive network of agents who will come to your doorstep.

- Why Choose HDFC?

- Doorstep Service: You literally never have to visit the branch.

- Pre-Approved Loans: If you have a salary account with them, you can get a sanction letter in 24 hours.

- Legal Technicalities: They are more flexible with older buildings (20+ years) in nodes like Vashi and Nerul, where SBI might reject the loan due to technical reasons.

- The Downside: Their interest rate spread can sometimes reset higher than public sector banks after a few years if you don’t keep an eye on it.

- Processing Fee: Up to 0.50% or capped at ₹3,000 – ₹5,000 for salaried employees.

3. ICICI Bank

The “Digital Friendly” Lender

ICICI has revolutionized the loan process with their digital sanction letters. For tech-savvy professionals living in Airoli or Ghansoli, this seamless experience is a huge plus.

- Why Choose ICICI?

- Top-Up Loans: They are very generous with Top-Up loans (extra cash for renovation) once you have paid EMIs for 12 months.

- Balance Transfer: They aggressively target customers looking to switch their loans from other banks, often offering zero processing fees for balance transfers.

- The Downside: Pre-payment charges (for non-individuals) and other service charges can be slightly higher.

4. Bajaj Housing Finance & LIC HFL

The Challengers

Don’t ignore Housing Finance Companies (HFCs).

- Bajaj Housing Finance: Excellent for those who want a high loan eligibility amount. They often count variable pay and bonuses more generously than banks.

- LIC HFL: Great for long tenures (up to 30 years) and for pensioners. Their “Griha Varishtha” scheme is popular among retired professionals settling in Panvel.

Public vs. Private Sector Banks: Which is Better for Navi Mumbai?

This is the classic dilemma.

Public Sector (SBI, Bank of Baroda, Union Bank)

- Pros: Lower interest rates, total transparency, no hidden “service charges.”

- Cons: Slow processing (30-45 days), rigid legal verification (they will reject a property if even one document is missing).

- Best For: Resale flats with clear titles, CIDCO tender plots.

Private Sector (HDFC, ICICI, Axis)

- Pros: Lightning fast (7-10 days), better customer service, dedicated relationship managers.

- Cons: Slightly higher rates, higher processing fees, aggressive cross-selling of insurance.

- Best For: Builder under-construction projects, self-employed businessmen.

The “Hidden Costs” No One Tells You About

When you see an ad for “8.5% Interest,” that’s not the only money leaving your pocket. In 2026, budget for these extra costs:

- MODT Charges (Memorandum of Deposit of Title Deed): This is a state levy (0.2% – 0.5% of loan amount) paid to the Maharashtra government to register the loan.

- Legal & Valuation Fees: Banks hire third-party lawyers and engineers to value your property. Cost: ₹3,000 – ₹6,000 (Non-refundable).

- Property Insurance: Most banks insist you buy property insurance. While good to have, their partnered policies are often expensive. Pro Tip: You can buy this separately from any insurer for cheaper.

- CERSAI Charges: A small fee (₹50-₹100) to register the loan in the central database to prevent fraud.

Checklist: Documents You Need for Navi Mumbai Properties

Properties in Navi Mumbai have unique legal structures (CIDCO Leasehold, Tripartite Agreements). Ensure you have these ready to avoid rejection:

- For Resale Flats:

- Share Certificate (Original).

- NOC from the Society.

- Chain of Agreements (Past 30 years).

- CIDCO Transfer Order (Final Order).

- For Under-Construction:

- RERA Registration Number.

- Commencement Certificate (CC).

- Tripartite Agreement (Builder + Bank + Buyer).

Local Insight: If buying in Panvel or Ulwe, ensure the builder has the “Occupancy Certificate (OC)” if the building is ready. Banks like SBI are very strict about funding ready properties without OC.

How to Negotiate a Lower Interest Rate

- Improve Your CIBIL Score: A score of 750+ is your golden ticket. Banks have “Risk-Based Pricing,” meaning high scores get rates 0.10% – 0.25% lower.

- Apply During Month-End: Loan officers have targets. Walking in on the 25th of the month gives you leverage to ask for a processing fee waiver.

- The “Balance Transfer” Threat: If your current bank refuses to lower rates, get a sanction letter from a competitor and show it to them. They will usually match it to keep you.

- Women Co-Applicants: Most banks (especially SBI and HDFC) offer a 0.05% discount if a woman is the primary or co-applicant.

FAQs

Q1: What is the current home loan interest rate in Navi Mumbai for 2026?

A: As of early 2026, home loan rates generally range between 8.40% and 9.50% p.a. Public sector banks like SBI start around 8.40% for salaried individuals with CIBIL scores above 750.

Q2: Which bank is best for CIDCO property loans?

A: SBI and Union Bank of India are excellent for CIDCO properties because their legal teams are experts in verifying leasehold documents. Private banks like HDFC are also good but ensure the property has a clear “CIDCO Transfer” approval.

Q3: Can I get a 100% home loan in India?

A: No. RBI guidelines mandate that banks can only fund up to 75% – 90% of the property value (LTV Ratio). You must arrange the remaining 10% – 25% as a down payment. However, registration and stamp duty charges are usually not covered in the loan.

Q4: Is property insurance mandatory for a home loan?

A: Legally, no. However, most banks will strongly pressure you to take it to protect their asset. You have the right to decline their specific policy and buy a cheaper one from an external provider (e.g., Acko, Digit, or GoDigit).

Q5: How does a floating rate differ from a fixed rate?

A:

- Floating Rate: Linked to the Repo Rate. If RBI cuts rates, your EMI goes down. (Recommended for 95% of buyers).

- Fixed Rate: The rate stays the same for 2-3 years or the full tenure. These are usually priced 1-2% higher than floating rates and are generally not recommended unless the economy is highly volatile.

Choose Smart, Save Big

A home loan is a long-term relationship—likely the longest one you will have outside of your marriage! Don’t just sign with the first bank that offers you money. Compare the APR (Annual Percentage Rate), which includes the interest + processing fees, to see the real cost.If you have a clean profile (Salary slips + High CIBIL), SBI is your wallet’s best friend. If you need speed or are self-employed with complex income proof, HDFC or ICICI will get you across the finish line faster.