Stamp Duty & Registration Charges in Navi Mumbai: The 2026 Calculator

Navi Mumbai in 2026 is unrecognizable from the satellite city it once was. With the International Airport fully operational and the Atal Setu bridge cutting travel time to South Mumbai to under 40 minutes, property here isn’t just a roof over your head—it’s a high-stakes asset in India’s most dynamic economic corridor.

But for homebuyers and investors, the glossy brochures hide a complex financial reality. The “price” of a property is never just the agreement value. Between the new “Metro Cess,” floor-rise premiums, and the specialized CIDCO transfer fees, the statutory overheads can easily add another 10% to your budget.

This guide is your financial GPS. We strip away the legal jargon to give you the 2026 Stamp Duty & Registration Calculator—a definitive roadmap to understanding every rupee you will pay to the government, from Vashi to Panvel.

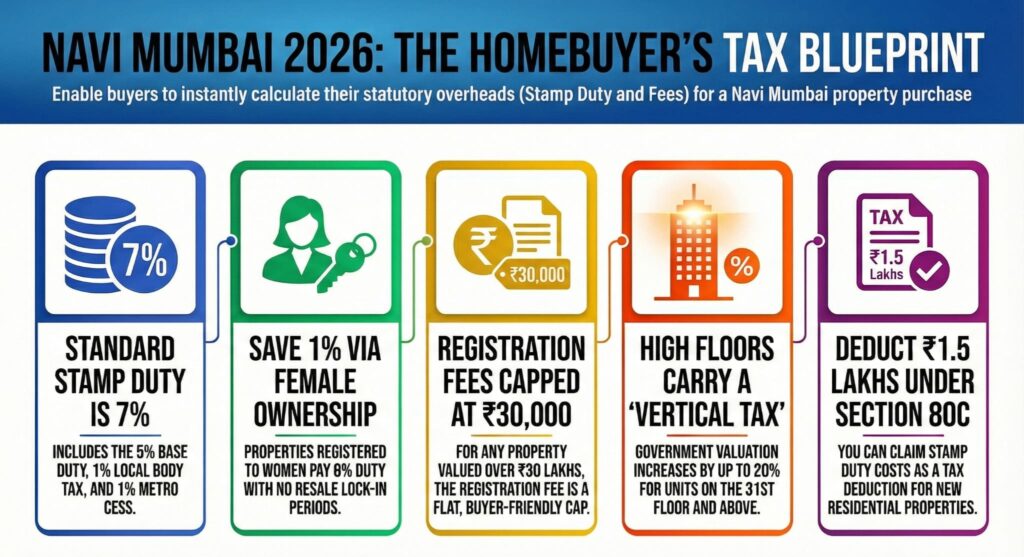

Quick Summary: 2026 Rates at a Glance

| Buyer Category | Total Stamp Duty* | Registration Fee |

| Male | 7% | 1% (Capped at ₹30,000) |

| Female | 6% | 1% (Capped at ₹30,000) |

| Joint (Male+Female) | 7% | 1% (Capped at ₹30,000) |

| Joint (Female+Female) | 6% | 1% (Capped at ₹30,000) |

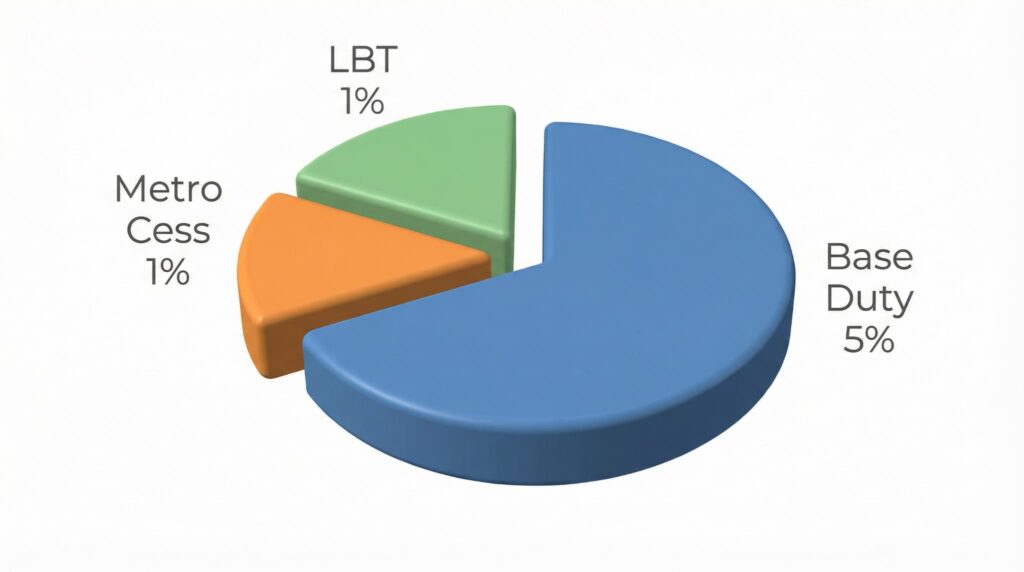

Total Stamp Duty includes 1% Local Body Tax (LBT) and 1% Metro Cess.

1. The Fiscal Architecture: What Are You Paying For?

In 2026, buying property in Navi Mumbai is governed by a digital-first regime under the Maharashtra Stamp Act. The days of cash dealings and vague paperwork are over; today, every transaction is authenticated via Aadhaar and secured on a blockchain-backed registry.

Stamp Duty vs. Registration Charges

Think of Stamp Duty as a tax on the transaction value. It’s a major revenue source for the state, used to fund the very infrastructure (like the Metro) that is boosting your property’s value. It is an ad valorem tax, meaning it scales with the price of the property.

Registration Charges, on the other hand, are an administrative fee for recording your deed in the government’s permanent archives. In Maharashtra, this is surprisingly buyer-friendly for high-value homes:

- Properties below ₹30 Lakhs: 1% of the value.

- Properties above ₹30 Lakhs: A flat cap of ₹30,000.

Pro Tip: Whether you buy a ₹1 Crore flat in Kharghar or a ₹10 Crore villa in Palm Beach Road, your registration fee remains stuck at ₹30,000. This cap is a massive relief for luxury buyers.

2. The 2026 Rate Card: Gender, Geography & Government

Your final tax bill depends on three “Gs”: Gender, Geography, and Government Valuation.

The “Gender Advantage” (1% Concession)

Maharashtra continues to champion female homeownership in 2026. If the property is registered in the name of a woman (or two women jointly), the stamp duty is a flat 6% instead of the standard 7%.

- The Math: On a ₹1.5 Crore apartment in Seawoods, this 1% rebate saves you ₹1.5 Lakhs instantly.

- The Catch: In the past, women couldn’t sell such properties to men for 15 years without paying back the rebate. Good News: By 2026, this lock-in period has been removed, making female-owned assets highly liquid.

The Components of the 7% Duty

Why is it 7%? Here is the breakdown:

- Base Stamp Duty: 5% (The core state tax).

- Local Body Tax (LBT): 1% (Goes to NMMC/PMC for civic maintenance).

- Metro Cess: 1% (A surcharge introduced to fund the Navi Mumbai Metro and MTHL projects).

3. Ready Reckoner Rates (RRR): The “Airport Effect”

The Ready Reckoner Rate (RRR) is the government’s minimum valuation for property in a specific area. You cannot pay stamp duty on a value lower than this, even if you bought the flat at a discount.

In 2026, the RRR in Navi Mumbai saw a sharp hike, driven by the “Airport Effect.” Areas closer to the new Navi Mumbai International Airport (NMIA) have seen the steepest rise.

2026 RRR Benchmarks (Residential)

- Vashi: ₹1,03,000 / sq. m (The Premium Hub).

- Kharghar: ₹88,700 / sq. m (The Smart City).

- Ulwe: ₹58,800 / sq. m (The Airport Proxy – Up 74% in 5 years).

- Panvel: ₹66,600 / sq. m (The Affordable Logistics Hub).

Analysis: While Vashi remains the gold standard, affordable nodes like Ulwe and Dronagiri are closing the gap fast. The government is ensuring it captures the value created by its infrastructure investments.

4. The Advanced Calculator: Floor Rise & Depreciation

This is where most buyers get blindsided. The government doesn’t just look at the carpet area; it looks at height and age.

The “Vertical Tax” (Floor Rise Premium)

In a city of skyscrapers, a view costs money. The government adds a premium to the RRR based on your floor number:

- Floors 1-4: 0% (Base Rate).

- Floors 5-10: +5%.

- Floors 11-20: +10%.

- Floors 31+: +20%.

- Real World Impact: Buying a penthouse on the 35th floor in Belapur? Your taxable value is 20% higher than your neighbor on the 2nd floor. Prepare your budget accordingly.

The “Old is Gold” Relief (Depreciation)

For resale properties, the calculator offers mercy. Buildings depreciate in value over time.

- 0-2 Years: 0% Depreciation.

- 10-20 Years: -20% Depreciation.

- 20-50 Years: -30% to -50% Depreciation.

If you are buying a 15-year-old resale flat in Nerul, the government valuation drops by 20%, significantly lowering your stamp duty burden.

5. CIDCO Transfer Fees & The Freehold Revolution

Navi Mumbai is unique because most land is owned by CIDCO (City and Industrial Development Corporation). You are technically a “Leaseholder,” not a landowner.

The Transfer Fee Hurdle

Every time a resale flat is sold, you must pay a “Transfer Fee” to CIDCO to transfer the lease rights.

- Cost: ranges from ₹75,000 to ₹3 Lakhs depending on carpet area and node.

- NMMC Fee: The Municipal Corporation also charges a nominal transfer fee (approx 0.20% of property value) to update property tax records.

The 2026 Freehold Scheme

To simplify this, CIDCO now allows you to convert leasehold plots to Freehold by paying a one-time premium.

- Why do it? Once freehold, you never pay transfer fees again. It instantly boosts the resale value of the property.

- Recommendation: If you are buying a resale property, check if the previous owner has already done the freehold conversion. It’s a massive value-add.

6. Digital Compliance: The IGR Portal & Blockchain

Gone are the days of bribing agents to speed up registration. The Inspector General of Registration (IGR) portal handles everything.

- e-Stepin: You must book a specific 15-minute slot for your biometric verification at the Sub-Registrar’s office. No waiting in lines.

- Blockchain Security: Your Sale Deed now comes with a unique QR Code. Scanning this reveals the digital ledger entry, making it impossible for fraudsters to forge ownership documents.

- GRAS Payment: You can pay stamp duty online via the Government Receipt Accounting System (GRAS) using Netbanking, UPI, or Debit Cards. No more demand drafts.

7. Financial Hacks: Saving on Taxes

Paying 7% duty hurts. Here is how to soften the blow using the Income Tax Act.

Section 80C Deduction

You can claim a tax deduction of up to ₹1.5 Lakhs on stamp duty and registration charges under Section 80C.

- Condition: Only for new residential properties (not commercial or resale).

- Joint Owners Hack: If a husband and wife buy jointly, both can claim ₹1.5 Lakhs separately, effectively doubling the benefit.

GST on Under-Construction Homes

Don’t forget the Goods and Services Tax (GST).

- Affordable Housing (<₹45L): 1% GST.

- Other Under-Construction: 5% GST.

- Ready-to-Move: 0% GST.

Strategic Move: In 2026, smart investors often prefer “Ready-to-Move” resale flats in Vashi over new launches in Panvel simply to save that flat 5% GST cost.

FAQs

Q1: What is the stamp duty for female buyers in Navi Mumbai in 2026?

A: Female homebuyers enjoy a concession of 1%. The total stamp duty is 6% (4% Base + 1% LBT + 1% Metro Cess). This applies if the property is registered solely in a woman’s name or jointly with another woman.

Q2: How is the ‘Market Value’ of a property calculated for stamp duty?

A: The government compares two values:

- The Agreement Value (Price you pay the seller).

- The Ready Reckoner Value (RRR x Carpet Area + Floor Rise Premium).

Stamp duty is calculated on whichever figure is higher. You cannot pay duty on a value lower than the government’s calculation.

Q3: Are there any hidden charges apart from Stamp Duty?

A: Yes. Budget for:

- Legal Fees: ₹10k – ₹25k for title search.

- CIDCO Transfer Fees: ₹1L – ₹3L (for resale).

- Society Transfer Charges: ₹25k (max cap).

- Brokerage: 1% – 2% of the deal value.

Q4: Can I pay stamp duty online in Navi Mumbai?

A: Yes, via the GRAS (Government Receipt Accounting System) portal. You can use net banking or generate an e-Challan. You do not need to visit the bank physically.

Q5: What happens if I buy a flat in a building without an OC (Occupancy Certificate)?

A: Legally, you can register the deed, but you face huge risks. The NMMC may refuse to transfer water connections, and banks will reject your home loan application. Also, without an OC, you cannot claim the 0% GST benefit on resale.

The Final Calculation

In 2026, buying a home in Navi Mumbai is a statement of intent. You aren’t just buying square footage; you are buying into a globally connected ecosystem powered by the new airport and trans-harbour link.But with great infrastructure comes great taxation. The “2026 Calculator” teaches us one thing: Detail matters. A 35th-floor apartment costs significantly more in taxes than a 4th-floor one. A female co-owner saves you lakhs. And a freehold conversion is worth its weight in gold.